Money: Manifestation warning as people swear it's bagged them '£2,000 in bank account'

Table Of Content

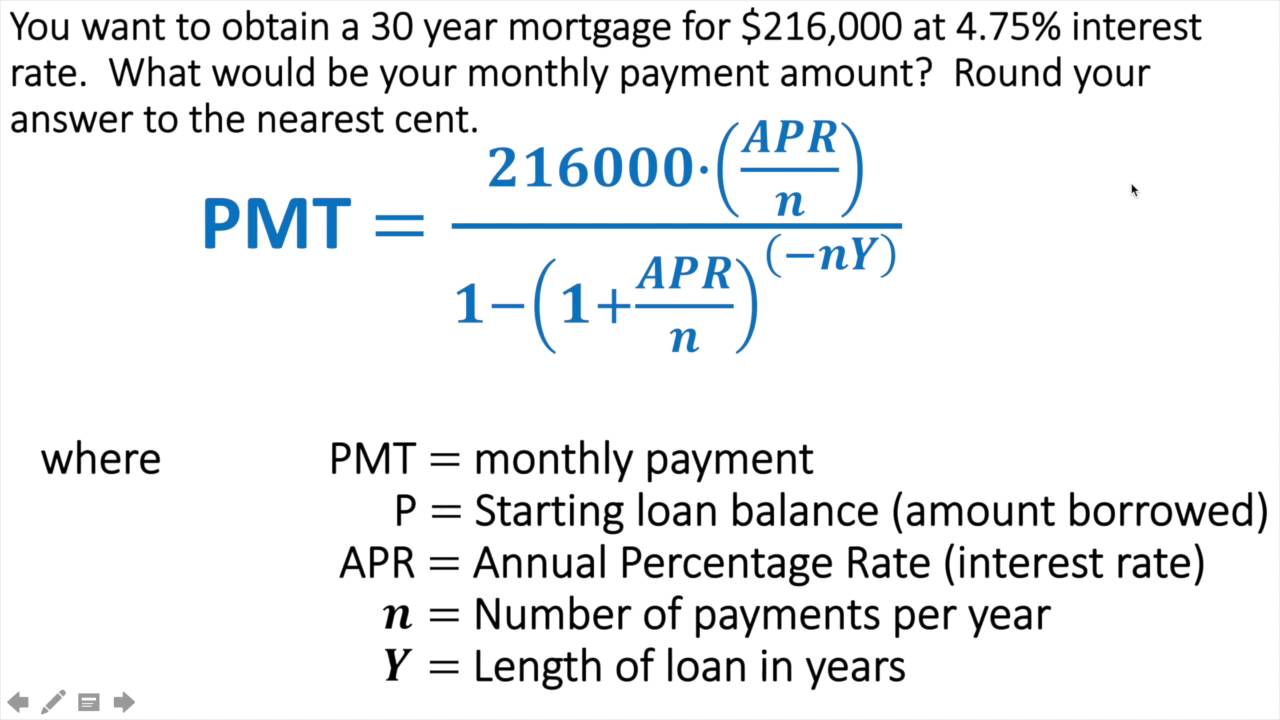

Shorter time horizons will require larger monthly payments, but you’ll pay less in interest over the life of your loan. Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. There are multiple ways an individual may lower their monthly payments, but some ways of decreasing monthly payments may have undesired consequences that should be considered.

Mortgage Calculator: Estimate Your Monthly Payments - Business Insider

Mortgage Calculator: Estimate Your Monthly Payments.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

How lenders decide how much you can afford

This mortgage payment calculator assumes that you have a 20% down payment, unless you specify otherwise. If you have less than a 20% down payment, you may have to pay private mortgage insurance (PMI), which would increase your monthly mortgage payment. This calculator doesn’t include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

What is a loan term?

On the other hand, if you have paid more than your obligation, then you will receive a refund of the difference. 4) Smaller mortgage payments – The smaller amount borrowed combined with the more favorable mortgage rates makes for a smaller mortgage payment every month. Since the amount owed is smaller, then there is less principal to be repaid. Moreover, the interest rate applied to this amount is lower, which means the mortgage payments will be smaller as well. 3) Better mortgage rates – Borrowers who can afford to make a 20% down payment are seen as more creditworthy and less risky than borrowers who choose to make a smaller down payment.

How To Calculate How Much Home Equity You Have (2024) - MarketWatch

How To Calculate How Much Home Equity You Have ( .

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

Edit Your Mortgage Details

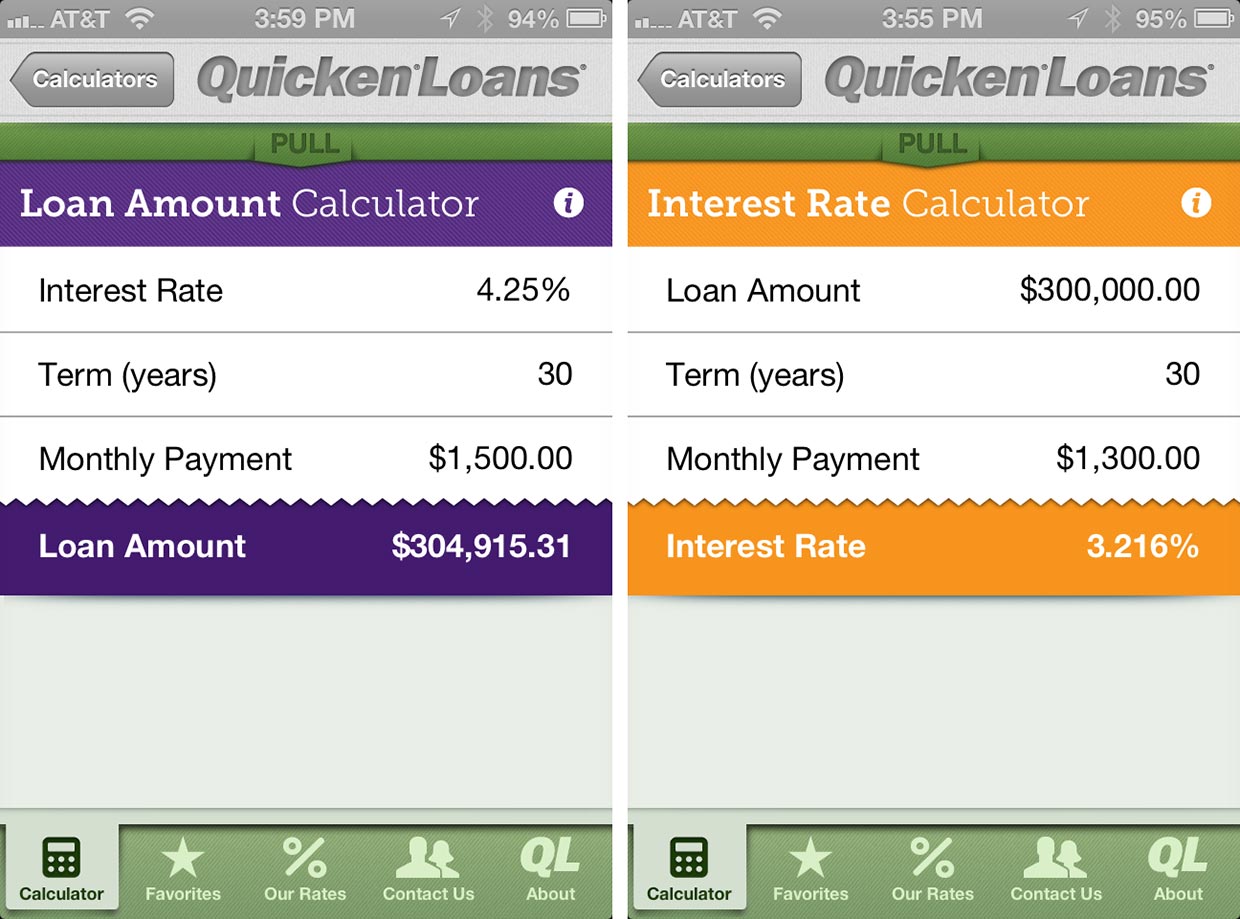

Or, you can use the interest rate a potential lender gave you when you went through the pre-approval process or spoke with a mortgage broker. Purchase price refers to the total amount you agree to pay to the property’s seller. This amount is typically different from your loan amount, since most lenders won’t loan you the full amount of a property’s purchase price. You can also see what the effect of a one-time, monthly or yearly additional payment would be on your number of monthly payments or interest. Crunching the numbers and wondering how mortgage rates are determined?

Calculate mortgage rates

The mortgage term is the period of time throughout which a borrower will pay off their mortgage, and the interest on it. In the U.S., mortgage terms are typically as long as their amortization periods, which is why the terms are used interchangeably. If you choose to pay some of the principal earlier, make sure to look out for prepayment penalties.

How to Lower Monthly Mortgage Payments

You can adjust your monthly mortgage payment by changing the loan terms. When you take out a conventional mortgage, most lenders will expect some kind of down payment. A down payment is a percentage of the entire loan amount you pay upfront before closing on the mortgage. To avoid paying private mortgage insurance (PMI) on a conventional loan, lenders expect a down payment of at least 20%. If you pay less than 20%, lenders will expect you to pay PMI as part of your mortgage payment each month. The monthly mortgage payment on a $300,000 house would likely be around $1,980 at current market rates.

Home affordability begins with your mortgage rate

Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year. Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts, or even edit them to zero, as you're shopping for a loan. This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid.

She explained that some people will be very specific with their desires, like selecting a photo of the exact car they want, or the perfect house, but that isn't how manifestation works. There needs to be an element of trust in the universe giving them what they attract. But some courses have popped up online which cost more than £1,000. "It's happened on so many occasions, like four, five times," he said.

How to Get A Mortgage?

Our mortgage calculator can help you estimate your monthly mortgage payment. This calculator estimates how much you’ll pay for principal and interest. You can also opt to includes your taxes and insurance in this payment estimate.

Read our guide to learn how they’re calculated, plus how to get the best rate possible. Using the Rocket Mortgage calculator is a good way to get started. This calculator can help you determine the type of home you can afford.

However, with a 15-year fixed, you’ll have a higher payment, but will pay less interest and build equity and pay off the loan faster. Therefore, if you are willing to take on the risk of rising interest rates and want to benefit from the initial lower rates, an adjustable-rate mortgage is right for you. D) The costs you will have to pay as a result you will own the house.

It’s factored into your monthly payment and paid off throughout the life of your loan. The terms available to you will depend on your financial situation and the type of loan you choose. Your principal and interest payments as well as your interest rate will typically drop with a smaller loan amount, and you’ll reduce your PMI premium. Plus, with a 20% down payment, you’ll eliminate the need for PMI altogether.

On desktop, under "Interest rate" (to the right), enter the rate. Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years. Under "Home price," enter the price (if you're buying) or the current value (if you're refinancing). This phenomenon is known as "fiscal drag" and it's often called a stealth tax because it's not as noticeable immediately in your pay packet.

Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. This formula can help you crunch the numbers to see how much house you can afford. Alternatively, you can use this mortgage calculator to help determine your budget. In addition, the calculator allows you to input extra payments (under the “Amortization” tab).

Mortgage refinance is the process of replacing your current mortgage with a new loan. Often people do this to get better borrowing terms like lower interest rates. Refinancing requires a new loan application with your existing lender or a new one.

Comments

Post a Comment